Money is impossible to ignore. Money dictates what we eat, who we see, where we go, and how we move. Paying and earning money is how we exchange value. It determines the work we do, the art we make, and the gifts we give.

Some artists use the money they have on what matters—gifting themselves materials or blocks of free time, renting a gallery space to show their work, or redirecting funds toward a cause that’s important to them. Other artists despise thinking about money or having to make money. They lament the power money has to deepen societal inequities. Their day job, which represents their need for money in exchange for time, is the scapegoat for their inability to make art.

If we want to create art, and more broadly create a better vision for society, we need to think about money. It’s not just about ideating how we can make more more more, but reflecting on what we believe our money gives us and whether we’re directing our flow of money in a positive direction. Ultimately the flow of our money represents our energetic exchange with others, as does our creative work. If the two are misaligned, you will feel adrift in cognitive dissonance.

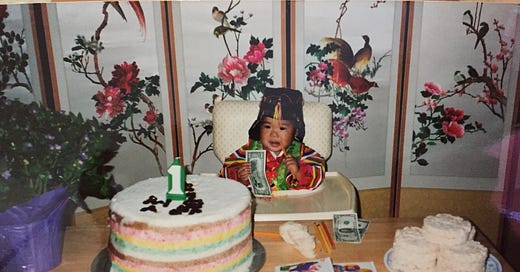

My money trauma is that I don’t believe I deserve to spend money, especially on myself. This goes hand in hand with growing up in an immigrant household. My parents always made sure to save lots and spend little so they could send their two children to college debt-free. I am so grateful for every money lesson that I’ve learned from my parents, and it has given me the skills of financial prudence during economic turmoil.

On the flip side, I’ve caught myself spiraling over the tiniest spending conundrums. I’ll hesitate to swipe my Metrocard and spend $2.90 to travel twenty blocks even though my legs are tired. I’ll refrain from buying a $2 bottle of water even though I know I’m dehydrated. As someone who’s made six figures working in tech for over seven years, the scrimping and saving at this minute level makes no logical sense. But hey, that’s trauma.

At the precipice of taking even bigger risks, my money fears kick in and I’m often unable to take the leap. I look backwards, believing I need to clear more hoops before I’m finally ready. I look at the plan I had and suddenly notice all of its flaws.

I’ve always assumed that having more money meant feeling more safe. I bet most of you believe that too. But if you have more than enough1 without having heart-forward values to channel where that money is going, what is the point? If you are unable to direct your own money to give love to yourself, where does the energy of that money go? How long will it stay stuck?

It’s time I really examine my deep-rooted beliefs around money and accept that I need help (and spend money to receive the right kind of help!) I stoke the flames of my fear the longer I hoard my money, and I lament the missed opportunities around sharing my art, building my business, and developing a deep trust and confidence in myself as I move through it all.

I’ve written to you before that you don’t need another class. And it’s true: we often look to classes for outward direction of our creative dreams instead of getting very specific about what we want for ourselves, especially if few others have charted our path and our ideas have not been validated in the market.

What we do need is to invest in getting support if you have big dreams. This could be therapy, coaching, extended time off, childcare, or outsourcing work that drains you. Or it could be a class or workshop after all, taught by your mentors and role models.

Annie Dillard wisely gave us the quote, “How we spend our days is how we spend our lives.” It also follows that how we spend our money is how we spend our lives, for we spend money throughout our days. Is your money flowing to where you want it to go, or are you blocking the flow to your dreams?

Thank you for reading 💞 Money can be a really heavy topic (I cried while writing this!) so I invite you to share gently, and only if you’re ready, about any of your own money fears. Comments are open or you can reply to this email to share with me privately 📧

Let’s say “enough” is around $105,000 in the US or $145,000 in NYC, according to USA Today which cites this Purdue study.

This was like reading something my past self would've written, right down to the tears. What completely changed my life was when I started to use a budget app (I cannot recommend YNAB enough!!). The reason is that—after assigning money to all my bills—I then carefully curate categories that provide me with joy and quality of life. To speak to one of your anecdotes, I even have a transportation category outside of gas (for the bus, Uber, and even scooter rides). I also have a category dedicated to Artwork because supporting other artists like me is super important to me. So if I fall in love with something, I check my category, see if I've saved enough, and then spend 100% guilt-free because my past self declared it was ok to put my money there. Likewise I have a "Compassion" category for donations and a "Treating My Peeps" category for when I want to buy a friend a coffee. YNAB also helped me finally start putting money into my IRA that was sitting dormant since I left my more "stable" job 8 years ago to freelance. I now realize that I was so frugal and guilty because I really had no idea how much money I had to spend after bills. Or I was fearful that some huge bill would come my way so I never wanted to feel unprepared. My bank and savings would just sit there doing nothing while I lived in constant anxiety. Now I have categories dedicated to pop-up medical expenses and car repairs (had enough saved when a whopping $1200 repair came my way this year!) BIG BREATH. I know I sound like a commercial, haha!! But I always share my story about YNAB with folks because it's made such a gigantic difference in my life. And maybe someone reading this needs the nudge too!

Oh, I feel this so much, especially the part about not wanting to spend $2.90 on a subway ride! (Why is that such a difficult expenditure?) My money trauma is a huge conflict where half of me believes I don't deserve to earn "enough" and the other half spends wantonly on myself anytime I have "excess." Ooof. Have you ever looked into your Human Design? It's been super illuminating and helpful for my unpacking of all this.